B Form E and CP8D must be submitted in accordance with the format as provided by LHDNM. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut.

Untuk makluman pengemukaan Borang Nyata Cukai Pendapatan BNCP Lembaga Hasil Dalam Negeri Malaysia LHDNM untuk tahun taksiran 2020 melalui e-filling bagi borang E BE B BT P MT dan TF boleh dilakukan pada tarikh yang dinyatakan dibawah.

Deadline for submission of borang e 2019. According to Lembaga Hasil Dalam Negeri LHDN the move is meant to facilitate the submission of tax returns affected by the national movement control order which starts today. The Internal Revenue Board LHDN has extended the deadline for income tax form submission until the end of June 2020. 2019 i Submission of a Complete and Acceptable Form E a Form E shall only be considered complete if CP8D is furnished on or before the due date for submission of the form.

From The Year of Assessment 2019 The tax or additional tax payable is subject to an increase in tax under subsection 77B4 of ITA 1967. Other than e-Data Praisi and e-Filing e-E CP8D must be submitted in Excel or txt file format by using compact disc USB drive external hard disk. How to step by step income tax e filing guide imoney.

An employer is required to complete this statement on all employees for the year 2019. The amount of increase in tax charged for an Amended Return Form furnished within a period of 6 months after the date specified in subsection 771 of ITA 1967 shall be 10 of the amount of such tax payable. Nama 5 7 Negeri-No.

Tarikh Akhir e-Filling 2021 LHDNPerhatian buat pembayar cukaiBila tarikh akhir hantar borang cukai efilling 2021 untuk tahun taksiran 2020. You will have to pay more. Each employer is supposed to furnish an employers return Borang E which details the remuneration paid to employees during calendar year 2019 by March 31 2020.

This will give you unnecessary costs that could have easily been avoided. Start a free trial now to save yourself time and money. B Form E and CP8D must be submitted in accordance with the format as provided by LHDNM.

This decision was made in conjunction with the Restricted Movement Order RMO that is in place from today until 31 March 2020 due to COVID-19 pandemic. How to check previous e filing malaysia. Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2019 pada 1 Julai 2020 BN tersebut akan dianggap sebagai lewat diterima mulai 1 Mei 2020 dan boleh dikenakan penalti di bawah subseksyen 1123 ACP 1967.

Lhdn E Filing Guide - e-Filing LHDN. Furthermore the process of tax computation and submission is also perceived as. A grace period of two months has been accorded so the deadline has been moved to May 31 see Table 1.

Похожие запросы для lhdn e filing borang be. Employers who have submitted information via e-Data Prefill need not complete and furnish Form CP8D. Form E for the Year of Remuneration 2018 i Submission of a Complete and Acceptable Form E a Form E shall only be considered complete if CP8D is furnished on or before the due date for submission of the form.

The penalty will be imposed if there is a delay in the submission of your Income Tax Return Form. ONLY in MALAYSIA Dateline. Efiling borang b form submission deadline 2021 telah disambung dan dilanjutkan pada tarikh akhir hantar tax dari 30 jun kepada 31 julai.

Payment of tax instalments. Cara isi eFiling Borang BE Online 2019. GUIDE NOTES ON SUBMISSION OF RF 2.

Originally the dateline for manual submission is 30 April 2020 while the e-Filing submission will. SCHEDULE ON SUBMISSION OF RETURN FORMS FORM TYPE CATEGORY DUE DATE FOR SUBMISSION E 2019 Employer 31 March 2020 BE 2019 Resident Individual Who Does Not Carry On Any Business 30 April 2020 B 2019 Resident Individual Who Carries On Business 30 June 2020 P 2019 Partnership BT 2019 Resident Individual Knowledge Worker Expert Worker. Malaysia Income Tax e-Filing Guide For Newbies.

Kegunaan majikan menyemak format dan memuat naik fail txt CP39 untuk dihantar. FAQ for Deadline for Malaysia Income Tax Submission in 2021 for 2020 calendar year 1. E-Daftar adalah aplikasi permohonan pendaftaran fail cukai pendapatan untuk pembayar cukai baharu mendapatkan nombor cukai pendapatan.

Cara isi efiling borang be online 2019. Tempoh perakaunan amanah pelaburan harta tanah REIT berakhir pada 31 Mei 2020. If you are late when submitting your tax form you will need to pay a penalty.

Ctos lhdn e filing guide for clueless employees. Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian. ByrHASiL adalah aplikasi elektronik untuk pembayaran cukai pendapatan melalui bank-bank yang dilantik.

Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran. 1 2019 CP8 - Pin. Is a Malaysian who works in Singapore need to declare tax to LHDN.

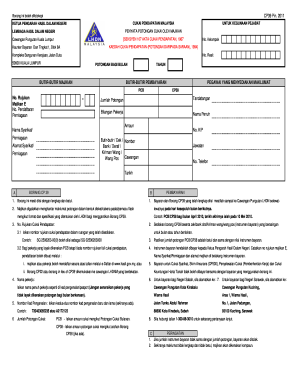

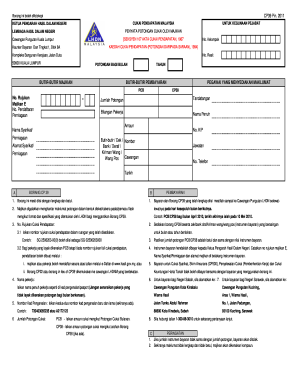

Thus the new deadline for filing your income tax returns in Malaysia via e-Filing is 30 June 2020 for resident individuals who do not carry on a business and 30. 2019 Borang SARAAN BAG I TAHUN E LEMBAGA HASIL DALAM NEGERI MALAYSIA PENYATA OLEH MAJIKAN CUKAI PENDAPATAN 1967 Borang ini ditetapkan di bawah seksyen 152 Akta Cukai Pendapatan 1967 Tarikh terima 1 Tarikh terima 2 UNTUK KEGUNAAN PEJABAT E. Form E and CP8D which do not comply with the format as stipulated.

30th April 2019 Last day for e filing 15th May 2019 In the same breath. Cara nak isi efiling lhdn borang be. Cara isi lhdn e filing 2021 online.

Borang E Fill Out And Sign Printable Pdf Template Signnow

Comments