Borang E e-E -Borang Nyata Oleh Majikan. EA on 12 January 2021.

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

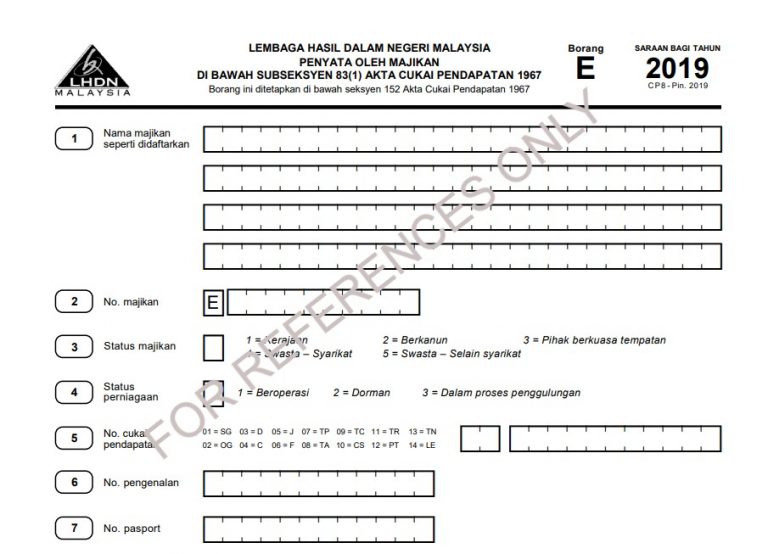

Form e-E All companies must file Borang E regardless of whether they have employees or not.

Borang e 2020 deadline. LHDNM ingin memaklumkan bahawa pengemukaan Borang Nyata Tahun Saraan 2020 dan Tahun Taksiran 2020 melalui e-Filing bagi Borang E BE B M BTMT TF dan TP boleh dilakukan mulai 1 Mac 2021. The reason is that employers who are not companies have the choice to send in Form E through e-Filing or paper form. 7 00 malam hingga 7 00 pagi.

Borang E yang diterima itu perlu dilengkapkan dan ditandatangani. 12032020 159348 Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March. Individuals Partnerships Form BE Resident Individuals Who Do Not Carry on Business YA 2019 30 April 2020 30 June 2020 Form B Resident Individuals Who Carry on Business YA 2019 F 30 June 2020 31 August 2020 o rm Pa tne ship.

Tambahan masa diberikan sehingga 15 Mei 2020 bagi e-Filing Borang BE Borang e-BE Tahun Taksiran 2019. A reminder on the below deadline- Borang CP8A CP8C EA EC - to all employees on or before 28 February 2021 Borang E dan CP8D on or before 31 March 2021. LHDN has released 2020 Borang E.

Borang R e-R-Penyata Baki 108 Tersemak. Untuk hampir kesemua borang cukai termasuk Borang BE dan sebagai alternatif pembayar cukai boleh mengemukakan borang cukai dengan menggunakan peranti. Is a Malaysian who works in Singapore need to declare tax to LHDN.

Borang C e-C -Borang Nyata Syarikat. A reminder on the below deadline- Borang CP8A CP8C EA EC - to all employees on or before 28 February 2021 Borang E dan CP8D on or before 31 March 2021. April 30 You might have heard that LHDN does not accept manual submissions from companies anymore yet the deadline for it is still there.

The deadline for submitting BT M MT TP TF and TJ forms non-merchants is April 30. If you are new to filing taxes for your company let us break it down for you. The deadline for business tax returns is June 30.

Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2019 pada 16 Mei 2020 BN tersebut akan dianggap sebagai lewat diterima mulai 1 Mei 2020 dan boleh dikenakan penalti di bawah subseksyen 1123 ACP 1967. Borang E Submission Deadline 2020. Borang E e-E-Borang Nyata Oleh Majikan.

Borang C1 e-C1-Borang Nyata Koperasi. 25012021 May 15 for electronic filing ie. Any dormant or.

28022021 Electronic filing Form e-E. With the announcement all taxpayers will be allowed to file their tax forms until 30 June 2020 regardless via manual submission or e-Filing. FAQ for Deadline for Malaysia Income Tax Submission in 2021 for 2020 calendar year 1.

Borang C e-C-Borang Nyata Syarikat. 19022021 Deadline for Malaysia Income Tax Submission in 2021 for 2020 calendar year. 06012021 Workers or employers can report their income in 2020 from March 1 2021.

Deadline of E Filing 2021 The deadline for filing tax returns has always been April 30 for manual submission and May 15 for electronic filing. Deadline Extended Deadline by e-Filing A. 30042021 for e-filing.

The deadline for Form B and P is June 30. The deadline for BE is April 30. LHDNM menambahbaik antaramuka bagi e-BE Tahun Taksiran 2020 yang boleh diakses menggunakan komputer dan peranti mudah alih pintar bagi menggantikan kemudahan m-Filing m-BE.

Borang R e-R -Penyata Baki 108 Tersemak. Program Memfail Borang Nyata BN Bagi Tahun 2021. Borang CP204 e-CP204-Borang anggaran cukai SyarikatKoperasiBadan Amanah Borang CP204A e-CP204A- Borang pindaan cukai SyarikatKoperasiBadan Amanah Pindaan ke-6 atau Pindaan ke-9.

Employers Form E Employers YA 2019 31 March 2020 31 May 2020 B. It is wise to remind taxpayers not to wait until the last minute to file tax returns. LHDN has released 2020 Borang E.

Employers tax obligations such as filing of Form E and preparation of employees Form EA would be at the companys agenda during the first quarter of every year. Form e for the year of remuneration 2019 i submission of a complete and acceptable form e a form e shall only be considered complete if c p 8d is furnished on or before the due date for submission of the form. 3 Individu Pemastautin Yang TIDAK Menjalankan Perniagaan boleh mengemukakan e-BE Tahun Taksiran 2020 melalui httpsmytaxhasilgovmy Sistem e-Filing akan dibuka mulai 1 Mac.

Menghantar surat makluman ke Cawangan di mana fail Majikan berada untuk tindakan supaya Borang E tidak lagi dikeluarkan pada masa akan datang sehinggalah syarikat tersebut beroperasi semula. The deadline for submitting Form E is March 31. EA on 12 January 2021.

18032020 Originally the dateline for manual submission is 30 April 2020 while the e-Filing submission will conclude on 15 Mei 2020. Isikan 0 di Bahagian A dan Bahagian B Borang E 2010. Borang C1 e-C1 -Borang Nyata Koperasi.

What if you fail to submit borang e and cp8d. The following information are required to fill up the Borang E. Program Memfail Borang Nyata BN Bagi Tahun 2020 Pindaan 32020 Contoh Format Baucar Dividen.

Understanding Lhdn Form Ea Form E And Form Cp8d

Comments