For Income Tax No. For income tax no.

Max Co Chartered Accountants Posts Facebook

This usually starts with either SG or OG.

Malaysia tax og number can filing borang be. KP Baru Write down your New IC number. Income tax number in the boxes provided. Jika wakil membuat permohonan bagi pihak pembayar cukai sila kemukakan.

SG 10234567080 Income tax no. 6 OLD IDENTITY CARD NO. New identity card number of precedent partnersole proprietor.

Old identity card number of precedent partnersole proprietor. For Income tax no. Registered with LHDNM Enter the last passport number filed with LHDNM prior to the current passport.

Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. The pin can be obtained from the nearest LHDN office or the Urban Transformation Centre. In the Year of Assessment 2010 since you are only physically present in Malaysia for only 179 days you are not considered a tax resident of Malaysia unless you extend your stay to 572010.

OG 1023456708 Example II. For the item Income tax no enter SG or OG followed by the income tax number in the box provided. SG 10234567080 Income tax no.

The e-filing steps will be enclosed together with the PIN number. For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. The deadline for filing your income tax returns form in Malaysia varies according to what type of form you are filing.

Your Income Tax Number consists of a tax reference type of 1 or 2-letter code followed by a 10 or 11-digit tax reference number. Rujukan Cukai Write down your Income Tax File Number. For the item Income tax no enter SG or OG followed by the income tax number in the box provided.

Borang BE 2008 - Personal Information. Regardless of how you plan to file your taxes one thing needs to be there your pin number. Go to the Nearest IRBM branch.

To use e-filing for the first time you need to get PIN number first. Registered with LHDNM Enter the last passport number filed. For the item Income tax no enter SG or OG followed by the income tax number in the box provided.

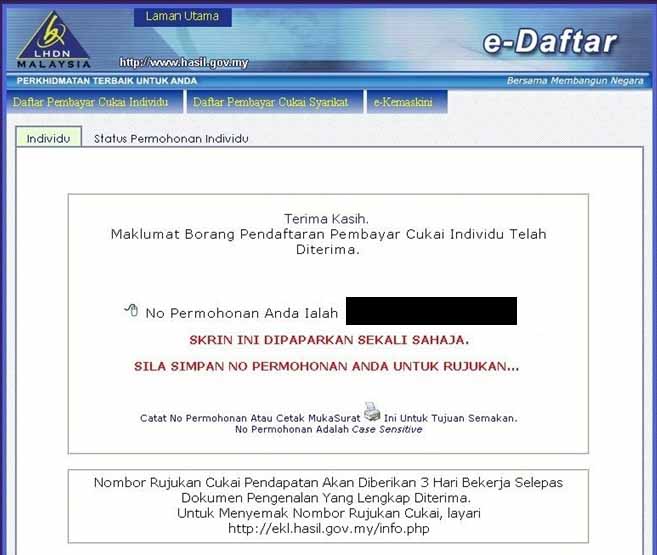

The Inland Revenue Board of Malaysia Malay. For first-time user you may register for a Malaysian Tax reference number online via e-Dafter. You can do so by.

The employment income of an individual who is a knowledge worker and resides in a specific region Iskandar Malaysia exercising employment with a person who carries on any qualifying activity namely green technology biotechnology educational services healthcare services creative industries financial advisory and consulting services logistic services and tourism will be taxed at the. For income tax no. D 1234567809 5 NEW IDENTITY CARD NO.

As for stopping you from setting foot outside Malaysia under Section 104 the Director General of the LHDN can also issue a certificate to any Commissioner of Police or Director of Immigration with your details and the details of any taxes you owe - and you can be prevented from leaving Malaysia until all your tax debts have been settled. 1 - 4 Fill in relevant information only. Lembaga Hasil Dalam Negeri Malaysia classifies each tax number by tax type.

Please bear in mind that you must be registered as Taxpayer prior to registering for ezHASiL e-Filing. Therefore you can be considered a tax resident of Malaysia for the Year of Assessment 2009 on 272010. Apply for PIN Number Login for First Time.

For Income Tax No. Registered with LHDNM Enter the last passport number filed with LHDNM prior to the current passport. Surat Kebenaran Pembayar Cukai b.

The process of registering is as follows. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. 03-8911 1000 Dalam Negara 603-8911 1100 Luar Negara.

For first time tax payers the Inland Revenue Board of Malaysia or better known in Malay as the Lembaga Hasil Dalam Negeri LHDN has made it a requirement to get the pin before starting your tax filings. OG refers to Others Group. For Company please select Pendarftaran Syarikat instead.

1 - 4 Fill in relevant information only. OG 5 Passport no. Identification Number of Applicant Representative Tarikh Date CP55D 32020 LEMBAGA HASIL DALAM NEGERI MALAYSIA BORANG PERMOHONAN NOMBOR PIN e-FILING INDIVIDU APPLICATION FORM FOR INDIVIDUAL e-FILING PIN NUMBER 2 3 5 Nota.

1 - 4 Fill in relevant information only. The most common tax reference types are SG OG D and C. Nama Write your full name as per IC.

Once you are on the e-Dafter page click on Pendaftaran Individu for individual income tax submission Borang Pendaftaran Online. SG refers to Salaries Group meaning your income is mainly from salaried. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2020 for manual filing and 15 May 2020 via e-Filing.

Send email to pinhasilgovmy and please attach copy of identity card front and back or passport. Before you can complete your Income Tax Returm Form ITRF via ezHASiL e-Filing the first step you have to take is to Register at ezHASiL e-Filing website. OG 10234567080 Income tax no.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing.

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Comments