How to ascertain theyve got your form. Jika ada baki cukai kena dibayar bayaran cukai juga perlu di bayar sebelum atau pada 30hb April.

Fail Cukai Pendapatan Cukai Pendapatan Your Tax We Care Halaman 2

Or operated a corporation with a permanent establishment in bc.

To file borang b or borang be. 20042018 After filing it you may proceed to serve the Notice of Change of Master to the three bodies. If you make this mistake your Short Call will be postponed until the next 2 weeks and you will then need to refile the corrected AOS again and wait for 2 weeks for the next Short Call. Borang_be_2019borang_b_2019borang_be_2018 borang_b_2018 anda nak tengok borang beb2019.

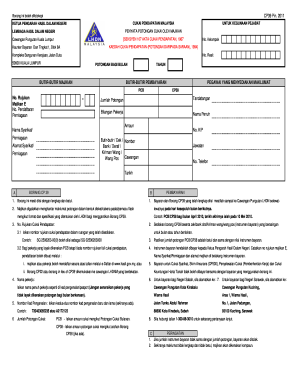

Nearby or you may submit the Form B via e-filing. NATURE OF BUSINESS 4. The e-filing steps will be enclosed together with the PIN number.

Borang BE untuk individu yang hanya ada pendapatan penggajian SAHAJA. While we were submitting the manual tax returns for some of our clients in Pandan Indah this morning we noticed that the IRD has generously extended the deadline for e-filing of Borang B. How do I submit the Form B through e-filing.

Apa beza Borang BE dan Borang B. PRESENT EMPLOYERS FILE NO. To use e-filing for the first time you need to get PIN number first.

Ii Selain itu anda boleh menghantar Borang B secara e-filing. The deadline is 30 Jun of each year. NAME AND ADDRESS OF BUSINESS AND PARTNERSHIP HusbandWife 3.

Step 8 Tomorrow go to the bank and bank-in over the counter the amount owed. Deadline for borang b submission. Biasanya terjadi bila tempoh hantar hampir berakhir.

Yang ada SSM enterprise sepatutnya no question dah pasal ni tapi biasalah hal percukaian ni memang tak pernah diajar di universiti kecuali untuk mereka dalam jurusan tertentu. In Borang 1 2 the correct Section to be cited are s10 s15 while in Borang 3 4 5 the correct Section to be cited are s36 2a b. Cara yang terbaik ialah keluar dari sistem dan masuk semula dalam 4 jam lagi.

Terima kasih buat panduan ni. DATE OF COMMENCEMENT OF BUSINESS if new business 6. Sila layari wwwhasilgovmy e-Filing httpsehasilgovmy Jika anda menghantar borang menggunakan e-filing anda tidak perlu lagi menghantar secara pos.

Individuals are categorized in two groups small individual traders who are not required to maintain audited accounts and the this is a tax system where. Anda nak tengok Borang BEB2020. Individual with business income is lapsing this 30th June for manual submission.

Or pay online if you wish. Tax filing for Borang B ie. ACCOUNTING PERIOD Opening and Closing date DayMonthYear 2.

INCOME TAX FILE NO. Find out when you need to file and if any tax credits or rebates apply to you. 19022021 FAQ for Deadline for Malaysia Income Tax Submission in 2021 for 2020 calendar year 1.

Manakala Borang B untuk individu yang mempunyai pendapatan perniagaan tak kira sama ada mempunyai pendapatan penggajian juga. These will be verified by the court in your Pengesahan Dokumen-Dokumen. Walau bagaimanapun tuan digalakkan untuk menggunakan borang yang betul iaitu Borang BE.

How to amend borang be. Pengembalian Borang B untuk diri sendiri puan dinasihatkan untuk mendapatkan Borang B di manamana cawangan LHDNM yang berdekatan atau membuat penghantaran secara e-filing. Send email to pinhasilgovmy and please attach copy of identity card front and back or passport.

Oleh kerana terlalu banyak trafik memasuki sistem e-filing maka sistem tidak dapat menampung beban dan sistem menjadi ralat atau down. Tetapi Borang B dengan punca penggajian sahaja mestilah dihantar sebelum atau pada 30hb April. HR Software can help you solve this by generating Borang E.

Setiap syarikat mesti mengemukakan borang e menurut peruntukan seksyen 831 akta cukai pendapatan 1967 akta 53. It fall under business income so Form B is the one u need to file in. Go to the Nearest IRBM branch.

Saya menerima dua Borang B untuk Tahun Taksiran yang sama tetapi di bawah nombor rujukan cukai pendapatan yang berlainan. Individuals Partnerships Form BE Resident Individuals Who Do Not Carry on Business YA 2019 30 April 2020 30 June 2020 Form B. Sila isikan pendapatan penggajian anda dalam borang B yang sama.

How to file your income tax. Untuk pemilik enterprise dan agen unit trust takaful borang B adalah borang cukai anda setiap tahun. 09032018 For the purposes of Borang 12 including the Affidavit Second Page of your Borang 1 fill in your forms as shown in the Tutorial Forms.

Hope they wont ask u submit the previous few yrs before. Apa beza Borang BE dan Borang B. Anda hanya perlu mengisi Borang B sahaja jika anda mempunyai pendapatan perniagaan dan juga anda perlu mengembalikan Borang B selewatlewatnya pada 30 Jun.

Affirm the two sets and get it filed at your firm. The deadline for Form B and P is June 30. The deadline for filing tax returns in Malaysia has always been.

ByrHASiL adalah aplikasi elektronik untuk pembayaran cukai pendapatan melalui bank-bank yang dilantik. EA forms for all you employees in just a few. Make a photocopy of Borang 6 and all the corresponding documents.

Kegunaan majikan menyemak format dan memuat naik fail txt CP39 untuk dihantar. Bolehkah saya menghantar Borang B melalui faks kerana saya kesuntukan masa untuk mengepos borang tersebut. Borang B boleh digunakan untuk melaporkan pendapatan penggajian.

E-Daftar adalah aplikasi permohonan pendaftaran fail cukai pendapatan untuk pembayar cukai baharu mendapatkan nombor cukai pendapatan. Martin deducts his personal allowance from his profit to work out his taxable income For company please select pendarftaran syarikat instead. For safekeeping print out the Borang B or Borang BE in PDF and the slip pengesahan which tells you how much you owe the Government.

Upon filing the Borang 6 head to your local High Courts Bahagian Rayuan Kuasa-Kuasa Khas and provide the court your Borang 6 set which has the original documents. You can do so by. Kenapa ada ralat bila nak hantar borang cukai pendapatan.

Cara Isi Borang E Filling Online Cukai Pendapatan Lhdn

Comments