The photocopy of Form B is not allowed as the photocopy form is not valid. Registered with LHDNM Enter the last passport number filed with LHDNM prior to the current passport.

709 Likes 5 Comments Re Imnotstudying On Instagram Economics Notes For Tomorrow S Exam Wi Apuntes De Clase Consejos Para Estudiar Estudiar Motivacion

If your business is registered with ACRA Accounting and Corporate Regulatory Authority please fill.

How to fill borang b guide. To begin the form use the Fill Sign Online button or tick the preview image of the form. If this is your first time taking this income tax thing seriously youll need to register first. Borang 16N Melepaskan Gadaian.

For Income tax no. Ensure every detail is correct and in order. BCMSN AUTHORIZED SELF-STUDY GUIDE 4TH EDITION PDF.

Remember you must ensure the organisation you donate to is approved by LHDN. Important things to take note about filing Form E. Enter a 0 in the last box of each item if that item is not applicable to you.

You fill up Borang P. Get it affirmed with the Commissioner of Oath. Key in your income details according to the relevant categories.

Salaries wages allowance incentives etc to be included in the CP8D form. Heres an easy last-minute guide to filing your taxes and getting tax reliefs. OG 10234567080 Income tax no.

You must be wondering how to start filing income tax for the. Your source of income will determine which form you have to fill up. If youve not declared any previous years income you need to declare it under Pendapatan Tahun Kebelakangan Yang Belum Dilaporkan.

You can now also do this online at wwwhasilgovmy. You fill up Borang B. 1 Tarikh akhir pengemukaan borang dan bayaran cukai atau baki cukai kena dibayar.

Share this if this was useful to you. Enter the full name of the employee as per his or. Deed of Assignment By Way of Transfer.

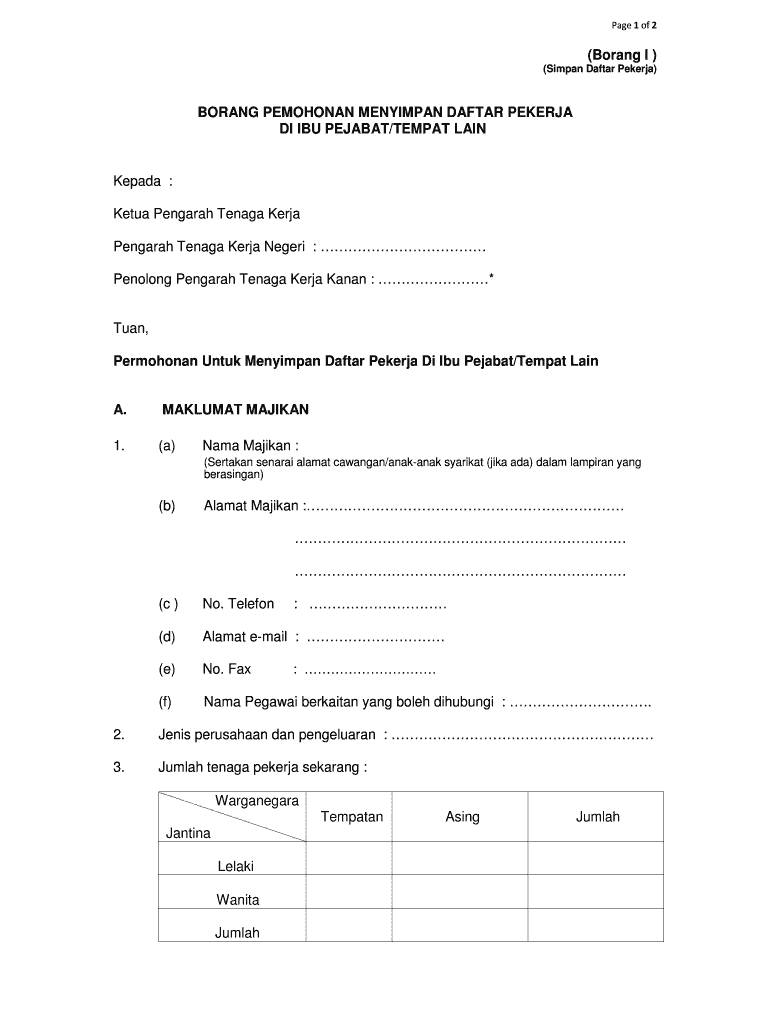

How you can fill out the Borang - Jabatan Tenaga Kerja - Ministry of Human Resources form on the web. 3 Kegagalan mengemukakan borang nyata pada atau sebelum tarikh akhir pengemukaan. In this document the guide of using ezHASiL system is listed for users reference.

Please fill in accordingly. OG 5 Passport no. C isi semua ruangan yang berkaitan dengan HURUF BESAR dan gunakan pen mata bulat berdakwat hitam.

At Deductions Rebate Tax Deductions Tax Relief users are able to fill in information regarding tax relief. Fill in the form with your income information according to the relevant categories. Do not leave any box blank.

B dapatkan Borang BE sekiranya TIDAK menjalankan perniagaan. Documents required to be attached to Borang 1 are Certified True Copies of the pupils i NRIC front and back. Choose your corresponding income tax Form e-BE and choose the assessment year tahun taksiran 2015.

Have you registered as a taxpayer with LHDN logged yourself into e-Daftar and familiarised yourself the right e-Borang to fill. Go to the official registration page and click on Borang Pendapatan Online. You can then declare any donations or gifts that you have received.

Borang BE or B. Click here for guidelines on filling out the Borang. You can get the Form B at any branch of the IRBM or you may submit the Form B via e-filing.

How to File Income Tax in Malaysia 2021 LHDNAre you filing your income tax for the first time. Refer to our tax deduction section to understand more about this deduction. 12 System Requirement.

1 Start off by registering. Enter your official identification and. How to complete Form B 1.

Can we fill up a photocopy return form for submission. Savemoneymy 3o June 2013 for partnership. Fill up the registration form.

Then each subsequent Borang E filed for the rest of the employees should be numbered as 2 3 etc. Pupils are advised to familiarise themselves with all the Borang. You are advised to obtain Form B from any branch of the IRBM nearby or you may submit the Form B via e-filing.

Drop the cents enter the dollars only. Borang 19B Memasukkan Kaveat Persendirian. Form Consent to Charge Gombak land office.

I ByrHASiL di Portal Rasmi Lembaga Hasil Dalam Negeri Malaysia LHDNM httpsbyrhasilhasilgovmy. Once you have logged in under the e-filing section click on e-Borang and that will take you to your tax e-filing form. Any amendments would cost you alot time and cost either through refiling or by filing in an Afidavit Pembetulan.

For the item Income tax no enter SG or OG followed by the income tax number in the box provided. Use the said Borang and not typing out the documents to avoid mistakes. 30 Jun 2021 2 Pengemukaan secara e-Filing e-B boleh dibuat melalui httpsmytaxhasilgovmy.

For the purposes of Borang 12 including the Affidavit Second Page of your Borang 1 fill in your forms as shown in the Tutorial Forms. Fill out Borang 1 2 3 4 and 5. In other words the first Borang E filled in for an employee should be indicated as 1.

You can find this information in the EA Form provided by your employers. The advanced tools of the editor will guide you through the editable PDF template. Deed of Receipt and Reassignment Form Consent to Transfer Gombak land office.

Also fill in the total of your monthly tax deductions PCB if any. For example for 85080 fill in 850. 1 - 4 Fill in relevant information only.

If youre still uncertain about it all heres our complete guide to filing your income taxes in Malaysia 2021 for the year of assessment YA 2020. Borang Tukar Nama. Place your cursor at for more information on tax relief.

The following information are required to fill up the Form E. 5 CARA PEMBAYARAN a Pembayaran boleh dibuat melalui.

My Borang I Fill And Sign Printable Template Online Us Legal Forms

Comments